Tesla Stock Decline and Its Impact on the Automotive Industry 2025

Tesla Stock Decline and Its Impact on the Automotive Industry

Introduction

Tesla, one of the most influential companies in the global automotive industry, has recently faced significant stock market challenges. The decline in Tesla’s stock price has raised concerns among investors, analysts, and automotive industry stakeholders. This article provides an in-depth analysis of Tesla’s stock decline, changes in price targets and delivery projections, the role of Elon Musk, and the broader implications for investors and the automotive sector.

Tesla Stock Decline

Analysis of Stock Decline

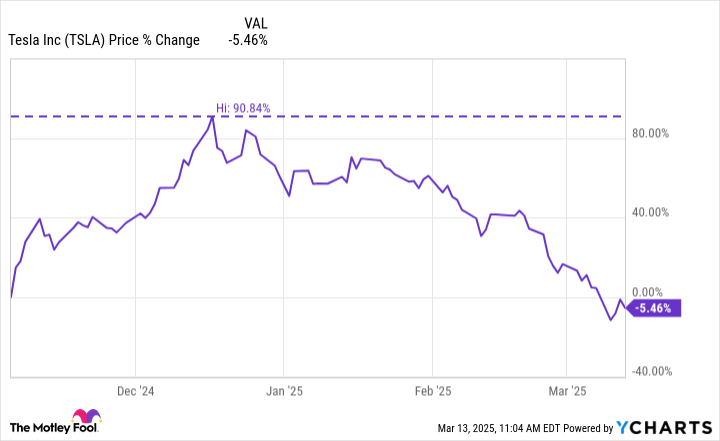

Tesla’s stock (TSLA) experienced a sharp drop, losing approximately 3% in value at 11:24 a.m. ET after JPMorgan Chase reduced its price target and raised concerns about delivery numbers. The decline represents a broader trend in Tesla’s market performance, reflecting investor anxiety over the company’s future growth and profitability.

Tesla has seen significant stock price volatility, with fluctuations driven by supply chain disruptions, competition, and global economic uncertainty. Since reaching its peak, Tesla’s stock has lost nearly 90% of its pandemic-era gains, leading analysts to question whether it can sustain its high valuation in a shifting market.¹

Comparison with Automotive Market History

Historically, automotive stocks have faced similar declines during economic downturns, supply chain disruptions, or major strategic shifts. Analysts have compared Tesla’s decline to previous downturns experienced by companies like Ford and General Motors during financial crises and industry-wide transformations.

However, Tesla’s situation is unique due to its dominance in the electric vehicle (EV) market and its role as a tech-driven company. While traditional automakers have relied on steady production and sales, Tesla’s valuation has been significantly influenced by investor sentiment, future technology potential, and the public perception of Elon Musk.

Changes in Price Targets and Delivery Projections

Revised Price Targets

JPMorgan Chase lowered Tesla’s price target to around $335 per share, signaling weaker-than-expected earnings growth. This reduction reflects concerns about slowing demand, competition from other EV manufacturers, and logistical challenges that could impact delivery efficiency.

Investors interpret this adjustment as an indication of potential future struggles, as Tesla has historically relied on aggressive growth strategies and high production targets to maintain its stock value.

Declining Delivery Projections

Tesla has also faced downward revisions in its vehicle delivery projections. Analysts had previously estimated deliveries of 1.8 million units for the year, but recent forecasts suggest a lower figure of around 1.65 million units. The primary reasons for this decline include:

- Supply chain issues: Global shortages in essential EV components have slowed production.

- Increased competition: Companies like Rivian, Lucid Motors, and legacy automakers such as Ford and Volkswagen have strengthened their EV offerings, challenging Tesla’s market share.

- Weakened consumer demand: Economic uncertainty has led some consumers to delay large purchases, including electric vehicles.

These factors have contributed to lower investor confidence, leading to further downward pressure on Tesla’s stock price.

The Role of Elon Musk

Controversies Surrounding Musk’s Involvement

Elon Musk, Tesla’s CEO, plays a pivotal role in shaping the company’s public image and investor sentiment. However, his involvement in various non-Tesla-related ventures, such as X (formerly Twitter) and SpaceX, has sparked controversy. Some analysts argue that Musk’s focus on external projects has led to management distractions within Tesla.

Government scrutiny has also added to investor concerns. Musk’s conflicts with regulatory agencies, including the U.S. Department of Energy and Securities and Exchange Commission (SEC), have created uncertainty about Tesla’s long-term stability.

Challenges in Measuring Negative Sentiment

Despite Tesla’s strong brand loyalty, Musk’s outspoken nature has made it difficult to measure the full impact of negative sentiment. While some investors continue to support Musk’s leadership, others view his erratic behavior and political statements as a risk to Tesla’s reputation.

Musk’s decision-making, including mass layoffs, pricing strategies, and aggressive expansion plans, has generated mixed reactions among analysts. This divergence in opinion contributes to continued volatility in Tesla’s stock price.

Risks and Implications for Investors

Investment Risk Assessment

Financial analysts warn that Tesla remains a high-risk investment due to its reliance on future technology breakthroughs and continued consumer demand for EVs. Key risks include:

- Overvaluation concerns: Tesla’s stock has often traded at a price-to-earnings (P/E) ratio significantly higher than traditional automakers, making it vulnerable to corrections.

- Dependence on government incentives: Many of Tesla’s EV subsidies are subject to policy changes, impacting affordability for consumers.

- Geopolitical factors: The U.S.-China trade relationship influences Tesla’s Gigafactory operations and component supply chains.

JPMorgan Chase’s revised outlook reflects these concerns, suggesting that Tesla’s stock may not have the same level of resilience seen in previous growth phases.

Positioning and Recommendations

Given these risks, analysts recommend that investors carefully evaluate Tesla’s stock before making long-term commitments. Some experts suggest:

- Diversifying portfolios: Investors should consider other EV manufacturers or renewable energy stocks to balance potential risks.

- Monitoring production data: Tesla’s quarterly delivery numbers will serve as key indicators of its ability to sustain growth.

- Assessing leadership decisions: Musk’s future actions and strategic focus will determine Tesla’s stability in the coming years.

Broader Impact on the Automotive Sector

Increased Competition in the EV Market

Tesla stock decline has influenced other EV manufacturers and legacy automakers. Competitors like Rivian, Ford, and General Motors have gained market attention as investors look for alternative EV growth opportunities. Some companies have leveraged Tesla’s setbacks to introduce competitive pricing strategies and improved vehicle offerings.

Regulatory and Policy Implications

Governments worldwide continue to push for EV adoption through tax incentives and environmental regulations. However, Tesla’s struggles highlight the challenges of scaling EV production profitably while maintaining sustainability commitments.

Consumer Perception and Demand Shifts

Tesla has long been perceived as the leader in EV innovation, but its recent stock decline may signal shifting consumer preferences. Factors such as reliability concerns, pricing strategies, and brand competition could reshape Tesla’s market position over the next decade.

Conclusion

Tesla stock decline reflects a combination of internal challenges, market dynamics, and investor sentiment shifts. While the company remains a dominant force in the EV industry, increased competition, regulatory pressures, and leadership controversies present significant hurdles.

For investors, Tesla’s volatility underscores the importance of careful risk assessment and strategic diversification. Meanwhile, the broader automotive sector will continue to evolve as other companies capitalize on Tesla’s setbacks to expand their own EV initiatives.

The future of Tesla remains uncertain, but its influence on the industry remains undeniable. Whether it can overcome these challenges and reclaim its market dominance will depend on its ability to adapt to an increasingly competitive and unpredictable global landscape.